Aug 7, 2018

Aug 7, 2018Do you need to make estimated tax payments?

Typically, if you receive a W-2, your taxes are automatically withheld. However, if you earn money from self-employment, interest, dividends, or rents, you will have to make estimated tax payments. This ensures that you’re paying your taxes.

Read on to find out the estimated tax payment schedule for 2019.

Estimated Tax Payment Due Dates

Generally, taxpayers can figure their estimated taxes and pay four equal portions of it throughout the year. You can also choose to pay your estimated tax by the tax deadline.

For instance, you can pay your estimated tax by April 15, 2019 or the dates below.

| Payment | Due Date |

|---|---|

| 1st Payment | April 15, 2019 |

| 2nd Payment | June 17, 2019 |

| 3rd Payment | September 16, 2019 |

| 4th Payment | January 15, 2020 |

On top of that, if you file your 2019 tax return by January 31, 2020, and pay the entire balance due with your return, you don’t have to make the payment due January 15, 2020.

What are the requirements for making estimated tax payments?

You can use Form 1040-ES if you are a U.S. citizen, resident alien, a resident of Puerto Rico, the U.S. Virgin Islands, Guam, the Commonwealth of the Northern Mariana Islands, and American Samoa. If you are a Nonresident alien, use Form 1040-ES (NR) .

For 2019, you’re required to pay your estimated taxes if you:

- Expect to owe less than $1,000 in taxes (the difference after subtracting your withholding and refundable credits) or

- Expect your withholding an refundable credits to be less than the smaller amount of:

90% of the taxes on your 2019 tax return or

100% of your taxes displayed on your 2018 tax return for all 12 months

For farmers, fishermen, household employers, and high-income earners, click here to view specific instructions.

You can choose how to make your payments.

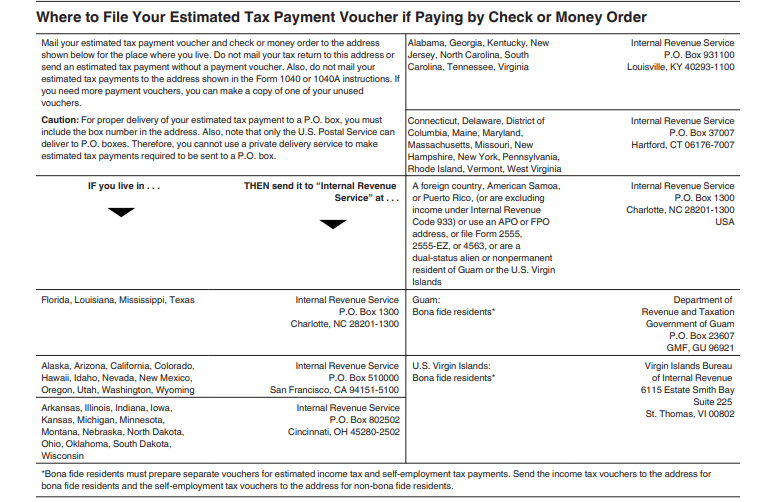

You can pay online, IRS Direct Pay, debit or credit card, electronic fund withdrawal, online payment agreement, the IRS2Go app, cash, the Electronic Federal Tax Payment System, check or money order. The addresses for paying by check and money order are displayed below.

You can face an underpayment of estimated taxes.

If you miss your payments or do not make your estimated tax payments throughout the year, you will be subject to penalties. The IRS determines your penalty by the number of days each portion of your taxes remains unpaid. They may waive your penalty if you meet either circumstance:

- You were unable to make any estimated payments due to a casualty event, disaster, or another situation out of your hands, or

- You’re retiring after reaching 62 years of age or became disabled during the current or prior tax year and the underpayment was due to reasonable cause and not willful neglect.

- Miscalculated estimated income tax payment due to the tax reform changes which will require you to complete the 85% Exception Worksheet

You can use Form 2210 to see if you owe any penalties of estimated tax for the 2018 tax year.

Here is the draft of Form 2210 for the upcoming 2019 tax year.

Qualifying for the exception.

You do not need to pay estimated tax for 2019 if you were a citizen or resident alien for the full 2018 tax year and your tax liability and total tax was zero or did not need to file a tax return. If you want to avoid making estimated tax payments, (in the case that you have a W-2 job) you can increase your withholding using Form W-4; the Employee’s Withholding Allowance Certificate.

Did you file your 2018 tax return as yet?

Hurry and file, especially if you missed an estimated tax payment so you don’t need to pay extra in late-filing penalties and interest!

Tags:

Categories:

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

Manisha Hansraj

Manisha Hansraj No Comments

No Comments