Feb 17, 2026

Feb 17, 2026Key Takeaways

- File immediately even without payment to avoid 5% monthly late filing penalty

- Request extension using Form 4868 if you need six months for paperwork only

- Set up installment plan via Form 9465 when you cannot pay balance in full

- Pursue offer in compromise if tax debt exceeds ability to pay without hardship

- File amended return to claim earned income credit or child tax credit retroactively

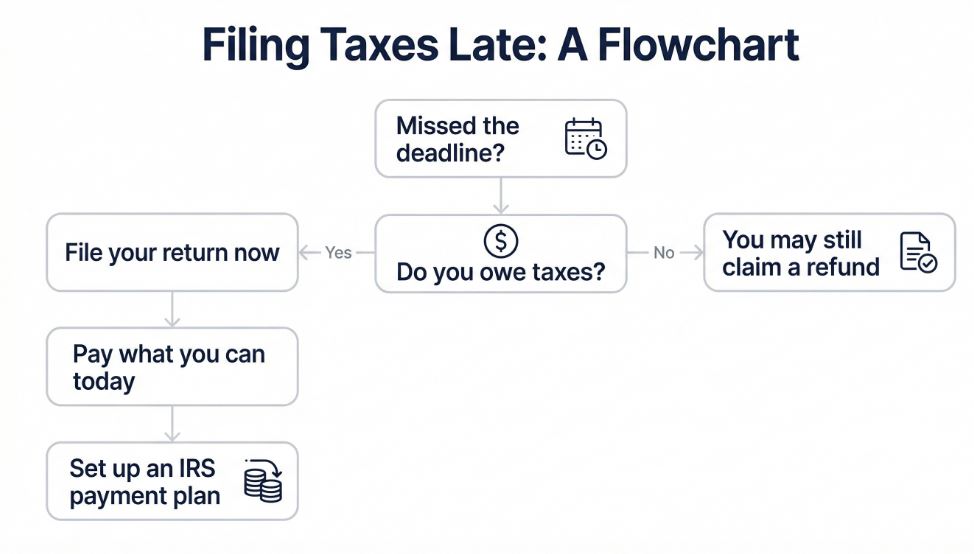

Filing taxes late triggers automatic IRS penalties starting at 5% of unpaid taxes per month, plus daily compounding interest and potential audit risk

Whether you missed the tax filing deadline unintentionally or due to circumstances beyond your control, understanding the repercussions can help you handle the situation and minimize the damage.

It’s essential to take timely action to address unpaid taxes and avoid further complications. The Internal Revenue Service (IRS) has strict rules about late filings and unpaid tax liabilities.

From late filing penalties to accruing interest on the tax due, the longer you delay, the more it could cost you. Knowing your options, such as filing an extension or setting up a payment plan, can alleviate stress and help you regain financial stability.

📋 Need to File Your 2025 Tax Return?

If you’re behind on filing, don’t let 2025 taxes become another late filing problem. The April 15, 2026 deadline is approaching fast. E-file your 2025 federal and state taxes online now to avoid the same penalties and stress you’re researching.

✓ Fast electronic filing ✓ Guided step-by-step process ✓ Get your refund sooner

What Happens If You Don’t File Taxes on Time?

If you don’t file taxes on time and take no action, the IRS doesn’t just wait.

After enough time passes without a filed return, the IRS can file a substitute return on your behalf using only the income data reported by your employers and banks.

The problem with a substitute return is that it won’t include any deductions, credits, or exemptions you’re entitled to.

The result is almost always a higher tax bill than what you’d actually owe if you filed your own federal income tax return. It also starts the collections clock, which can lead to IRS notices, wage garnishment, bank account levies, and eventually tax liens on your property.

Here’s the escalation timeline for unfiled back taxes:

- Months 1–6: Late filing penalty accrues at 5% per month. Late-payment penalty adds 0.5% per month. Interest compounds daily.

- Months 6–12: IRS sends CP14 (balance due) and CP501–CP504 notices. Filing penalty hits 25% cap.

- Year 1–2: IRS may file substitute return and assess additional tax. Collection actions begin.

- Year 2+: IRS can issue Notice of Federal Tax Lien, levy bank accounts, or garnish wages.

Filing your return (even years late) replaces the substitute return with your actual numbers.

In most cases, this reduces the amount owed significantly because you regain your deductions and credits. The IRS always prefers a voluntary filing over enforcement action.

Common Questions About Filing Taxes Late

If you’ve missed the tax deadline, here’s what you need to know right now:

Can you skip a year of filing taxes?

No. Skipping tax filing is illegal if your income exceeds the filing threshold for your status, even if you don’t owe taxes.

Consequences of not filing:

- IRS files substitute return without your deductions (higher tax bill)

- Statute of limitations never starts (unlimited audit window)

- You forfeit refunds and refundable credits permanently

- Multiple unfiled years trigger criminal investigation

Filing before the IRS contacts you can reduce risk, but criminal exposure depends on facts, intent, and amounts.

Do I have to file if I’m getting a refund?

Filing isn’t required for refunds, but you must file within 3 years to claim the money—after that, the IRS keeps your refund permanently.

Why file even with no tax owed:

- Refunds expire after 3 years from original deadline

- Claim earned income credit and child tax credit

- Future loan applications require recent tax transcripts

- Zero penalties for filing late with refunds

Example: 2023 refunds must be claimed by April 15, 2027.

Can I still file taxes if I missed the deadline?

Yes. The IRS accepts late returns anytime, and filing immediately stops penalties from growing while preserving your right to refunds and credits.

What you can still do:

- File Form 1040 now to stop penalty accumulation

- Claim refunds up to 3 years past deadline

- Set up payment plans using Form 9465

- File amended returns to correct past mistakes

No extensions available after April 15th—just file your return as soon as possible.

Will the IRS put me in jail for filing late?

No. Simple late filing results in civil penalties only. Criminal prosecution requires willful fraud or intentional evasion with substantial income.

What happens instead:

- Civil penalties: Fees, interest, payment plans, wage garnishment

- Criminal charges: Criminal cases generally involve willful conduct like fraud or intentional evasion, not ordinary late filing.

- Prosecution rate: Less than 1% of all taxpayers

- Voluntary filing: Reduces enforcement risk

Most late filers resolve issues through payment plans—not criminal court.

Is there a fine for filing taxes late?

Yes. The IRS calls it the failure-to-file penalty—5% of unpaid taxes per month, up to 25% of your balance. A separate late-payment penalty of 0.5% per month applies even if you file on time but don’t pay.

When fines don’t apply:

- You’re owed a refund—no penalty, no interest, no fine

- You filed for an extension and pay by April 15

- You qualify for first-time penalty abatement

- You can show reasonable cause (disaster, serious illness)

If you owe taxes, file as soon as possible—every month you wait adds another 5% to your penalty.

Missed the deadline and worried about penalties? Get a free assessment and find out which relief programs you qualify for.

Request Free Assessment →Consequences of Filing Taxes Late

How Much Is The Penalty for Filing Taxes Late?

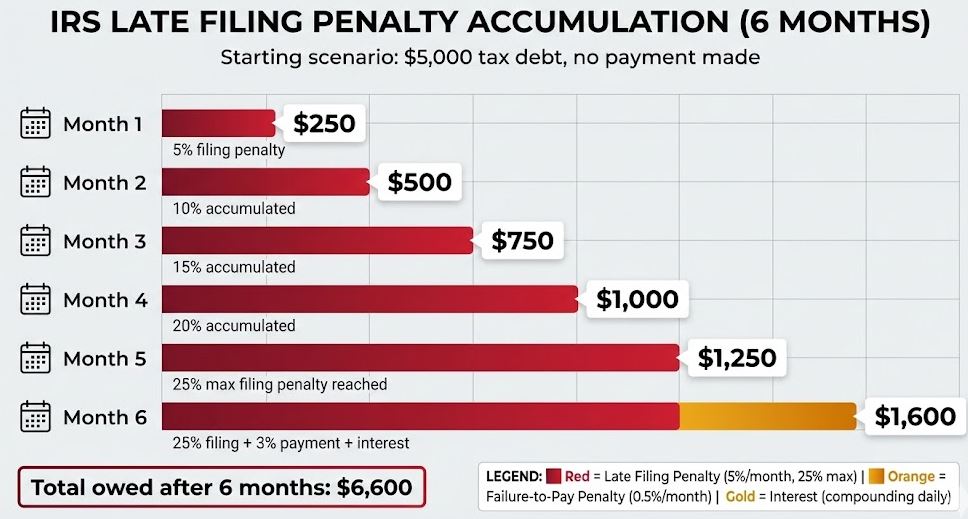

One of the most immediate consequences of filing taxes late is the late filing penalty.

Per IRS Publication 594, the late filing penalty is 5% of unpaid taxes for each month (or partial month) your return is late, capped at 25% maximum.

For example, if you owe $5,000 and file 3 months late, you’ll face $750 in filing penalties alone (5% × 3 months × $5,000) before interest and payment penalties. This assumes you still owe the full balance when you file; paying earlier can reduce failure-to-pay interest/penalties.

If your return is more than 60 days late, a minimum failure-to-file penalty applies. This minimum is inflation-adjusted and changes by filing year (for example, IRS guidance for returns required to be filed in 2026 references a higher minimum than older figures). Always verify the current minimum for the tax year you are filing.

If your return is more than 60 days late, the minimum penalty in 2026 is either $525 or 100% of the tax due, whichever is smaller.

In addition to the late filing penalty, the IRS charges additional fees for unpaid taxes. These fees include the failure-to-pay penalty, which is separate from the late filing penalty.

The failure-to-pay penalty is generally 0.5% of the unpaid tax amount for each month or part of a month the tax remains unpaid, capped at 25%. Together, these penalties can significantly increase your tax liability if you fail to file and pay on time.

Understanding how these penalties work is crucial for taxpayers who are unable to meet the tax filing deadline. Even if you cannot pay your taxes immediately, filing your federal tax return as soon as possible can help you avoid the late filing penalty and minimize the overall cost.

Interest Charges and Additional Penalties

When taxes remain unpaid past the due date, the IRS also adds interest charges to the amount owed.

The interest rate is determined quarterly and is calculated as the federal short-term rate plus 3% as outlined in IRS Tax Topic 653. This interest compounds daily, meaning the longer you delay, the more you’ll owe.

Additional penalties may apply for prolonged delays in addressing unpaid taxes.

For instance, if the IRS determines that your failure to file was due to fraud, you could face a penalty of 15% per month, up to 75% of the unpaid tax amount. While this is rare, it underscores the importance of filing your tax forms as soon as possible.

The IRS sets maximum penalty limits to prevent excessive charges, but these limits can still be substantial. The combination of penalties and interest can significantly increase the total tax liability over time, making it essential to address any outstanding tax obligations promptly.

Steps to Take If You Miss the Tax Filing Deadline

| Your Situation | Best Option | Key Details | Penalties Avoided |

|---|---|---|---|

|

April 15 hasn’t passed yet Need more time to organize paperwork |

✓ Request Extension (Form 4868) |

• Deadline: April 15, 2026 • Gives you until October 15, 2026 • Must still pay estimated tax by April 15 • File Form 4868 electronically (instant approval) |

Avoids 5% monthly late filing penalty (Extension does NOT extend payment deadline) |

|

Past April 15 Owe taxes but can’t pay in full |

File Return + Payment Plan |

• File Form 1040 immediately (stops 5% penalty) • Then request Form 9465 installment plan • Plans available up to 72 months • Setup fee: $0-$225 (waived for low income) |

Stops 5% monthly filing penalty Reduces late-payment penalty to 0.25% (from 0.5%) Prevents tax liens |

|

Past April 15 Owe taxes AND can pay in full |

✓ File Late + Pay Immediately |

• File Form 1040 now • Pay full balance via IRS Direct Pay • Request First-Time Penalty Abatement • Call IRS: 800-829-1040 |

FTA can waive 100% of late filing penalties Stops interest accumulation immediately Eligible if clean 3-year history |

|

Past April 15 Expecting a refund (no balance due) |

✓ File Anytime |

• Zero penalties for late filing with refund • Must file within 3 years to claim refund • Example: 2023 refund expires April 15, 2027 • No rush, but don’t wait past 3-year deadline |

No penalties ever apply No interest charges (But lose refund permanently after 3 years) |

Filing Late Federal and State Tax Returns

If you’ve missed the tax filing deadline, the first step is to file your federal income tax return as soon as possible.

Use form 1040 for individual tax filings and ensure all tax documents, such as form W-2, are accurately completed. Filing your taxes late doesn’t mean you forfeit your right to a refund or credits, but you need to act quickly to avoid additional penalties.

For state tax returns, the process varies depending on your state’s specific regulations.

Many states impose their own penalties for late filings, which can be separate from federal penalties. It’s essential to check your state’s tax agency website to understand the requirements for submitting returns for previous years.

Filing taxes late may seem exhausting, but it’s always better to file, even after the deadline, than to leave your taxes unfiled.

Late filing can reduce your chances of receiving money back, such as refunds or credits, and can trigger further consequences, including an IRS notice or audit.

Paying Taxes After the Due Date

Even if you cannot pay the full tax amount by the due date of the return, there are options to manage your tax liability.

You can use direct deposit or direct pay through the IRS website to make immediate payments. These electronic methods are secure and allow you to pay as much as you can afford, reducing your overall debt and interest charges.

What To Do If You Did Not File Prior Years Taxes

If you’re unable to pay the balance due in full, consider setting up a payment plan using form 9465, the IRS Installment Agreement Request.

This allows you to spread out payments over a period of time, making it easier to manage the financial burden. While you’ll still incur interest charges and late-payment penalties, a payment plan can prevent more severe actions, like tax liens or levies.

Additionally, if you’ve missed estimated tax payments throughout the year, you can include those amounts when addressing your balance due.

Making partial payments can demonstrate good faith to the IRS, potentially preventing further penalties.

How to File Late Taxes: Step by Step

Once you’ve decided to file taxes late, here’s the actual process. Whether you’re filing one overdue return or catching up on multiple tax years, these steps apply to every late federal income tax return.

Step 1: Gather your tax documents. Collect all W-2s, 1099s, and records of income for the tax year you’re filing. If you’re missing documents, request an IRS Wage and Income Transcript using Form 4506-T—this shows exactly what income the IRS has on file for you.

Step 2: Use the correct year’s tax forms. Each tax year requires that year’s version of Form 1040 and instructions. The IRS keeps prior-year forms at irs.gov/prior-year-forms. Using the wrong year’s form will cause your return to be rejected.

Step 3: File electronically or by mail. E-filing is faster and confirms receipt instantly. PriorTax supports e-filing for prior-year returns going back several years. If you must paper-file, mail your return to the IRS address listed in that year’s instructions and use certified mail to confirm delivery.

Step 4: Pay what you can or set up a plan. Use IRS Direct Pay to send a payment with your return. If you can’t pay the full balance due, file your return anyway and request a payment plan using Form 9465. Filing without paying stops the 5% monthly filing penalty immediately—even though the smaller late-payment penalty continues.

The most important thing is to file. Every month you delay costs you an additional 5% in penalties on top of compounding interest. Learning how to file late taxes and taking action now (even without full payment) is always cheaper than waiting.

How Filing Status and Credits Affect Late Filers

Tax Benefits You May Still Qualify For

Even if you’re filing late, you may still be eligible for certain tax benefits, such as the earned income tax credit or the child tax credit.

These credits can significantly reduce your tax liability or even result in a refund. For instance, the earned income tax credit is designed to benefit low- to moderate-income workers, while the child tax credit provides financial relief to families with dependent children.

Other deductions, such as mortgage interest and capital gains, can also apply even when filing late.

These deductions can help offset your tax liability, reducing the overall amount you owe. It’s important to include all eligible deductions and credits when completing your federal income tax return to maximize your potential benefits.

Choosing the Right Filing Status

Your filing status plays a significant role in determining your tax liability.

Whether you’re filing as single, married filing jointly, or head of household, each status comes with its own tax brackets and potential benefits.

Choosing the correct filing status ensures you’re taxed at the appropriate tax rate and can help you claim all eligible credits and deductions.

Families and small businesses have unique filing options that can further impact their taxes.

For instance, small business owners may need to file additional tax forms, such as form 1120 for corporations, to ensure compliance. If you discover mistakes on your original tax return, you can file an amended return to make corrections and potentially recover money back.

Resolving Tax Debt and Financial Hardship

IRS Programs for Managing Tax Debt

For taxpayers struggling with significant tax debt, the IRS offers several programs to help manage the financial burden.

One such option is the offer in compromise, which allows you to settle your tax debt for less than the full amount owed if you can prove financial hardship. This program is particularly helpful for individuals who cannot pay their tax liability without risking essential living expenses.

The IRS free file program and other free tax resources are also available to assist those with simple tax situations or limited income.

These tools can guide you through filing previous years’ taxes or making adjustments to reduce your tax debt. Additionally, understanding the statute of limitations for tax collection is crucial—generally, the IRS has 10 years to collect unpaid taxes from the date they are assessed.

Taking advantage of these programs can prevent the accumulation of additional fees and penalties while helping you regain control of your finances.

Seeking assistance from a tax professional or tax preparer with years of experience can also simplify the process and improve your chances of resolving your tax issues efficiently.

Avoiding Tax Liens and Credit Score Impacts

Failing to address unpaid taxes can result in severe consequences, including tax liens on your assets.

A tax lien is a legal claim by the government against your property, such as your home, car, or bank account, to secure payment of your tax debt. This can negatively impact your credit score and make it more challenging to obtain loans or credit in the future.

Taxpayers with retirement plans or savings accounts may also face penalties if funds are withdrawn to settle tax debts.

However, negotiating with the IRS over back taxes can often help you avoid the worst outcomes. By communicating with the IRS and demonstrating reasonable cause for your late payments, you may be able to prevent tax liens or reduce penalties.

Proactively addressing unpaid taxes, even if you can only make partial payments, can safeguard your financial health.

Using tools like the IRS website or consulting a tax professional can help you explore all available options to resolve your tax situation.

Tips for Preventing Late Tax Filings

Planning Ahead for Future Tax Seasons

To avoid the stress and financial strain of filing late, it’s essential to plan ahead for future tax seasons.

Mark key dates like tax day, which typically falls on April 15th, on your calendar to ensure you’re aware of deadlines.

Missing the due date of the return can lead to unnecessary complications, so staying organized is crucial.

If you anticipate needing more time to file, you can request an extension of time by submitting form 4868 before the tax filing deadline. While this grants you an additional six months to file your federal tax return, it does not extend the time to pay any taxes owed.

Ensuring your tax withholding and estimated tax payments are accurate throughout the year can also help you avoid surprises come tax day.

Engaging in proactive tax planning can make a significant difference in managing your tax situation. By keeping thorough records of your tax documents and staying informed about changes in tax laws, you can reduce your chances of filing late or owing additional tax.

Working with a Tax Professional

One of the most effective ways to prevent late filings is to work with a tax professional who can provide expert tax help tailored to your situation.

A qualified tax pro or tax preparer can help you navigate complex tax forms, such as form 1040 or form 1120, and ensure all necessary information is submitted accurately and on time.

Using trusted tools like PriorTax, H&R Block, or resources available on the IRS website can further simplify the filing process. These tools are especially helpful for individuals or small businesses with unique tax situations.

If you encounter issues, contacting IRS customer service through their phone number can provide clarification and guidance.

By partnering with a tax professional or utilizing trusted resources, you can minimize errors, maximize your tax benefits, and stay on top of your filing responsibilities.

This proactive approach reduces the risk of facing penalties, interest charges, or other consequences associated with filing taxes late.

IRS Relief Programs & Legal Considerations

Once you understand the basics, explore these relief options and legal questions:

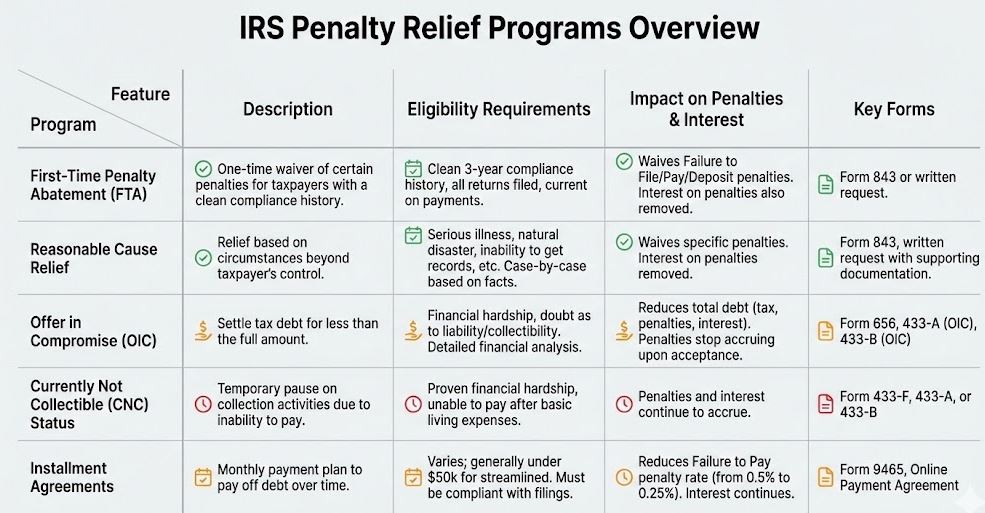

What IRS penalty relief programs are available for late filers?

The IRS offers five main relief programs: first-time penalty abatement, reasonable cause relief, offer in compromise, currently not collectible status, and installment agreements.

Program comparison:

- First-time penalty abatement: Waives penalties with clean 3-year history

- Reasonable cause: Removes penalties for circumstances beyond control

- Offer in compromise: Settles debt for less than owed (9% acceptance)

- Currently not collectible: Temporarily suspends collection during hardship

- Installment agreements: Spreads payments over time via Form 9465

Start with first-time penalty abatement—easiest to obtain and can save thousands.

What is first-time penalty abatement (FTA) and how do I qualify?

First-time penalty abatement waives failure-to-file and failure-to-pay penalties for one tax year if you have clean 3-year compliance history.

FTA requirements:

- Filed all returns (or extensions) for prior 3 years

- Paid all tax owed or arranged payment plan

- No penalties assessed in prior 3 years

- Currently compliant with filing and payments

Request by calling IRS at 800-829-1040 or submitting written request after penalties are assessed.

What triggers red flags to the IRS?

Audit triggers include income-to-deduction anomalies, claiming 100% business vehicle use, round numbers throughout returns, and income fluctuations exceeding 25% without explanation.

High-risk audit triggers:

- Home office deduction over 20% of residence

- Schedule C losses for 3+ consecutive years

- Charitable donations above 3-4% of income without receipts

- Cash business revenues inconsistent with industry norms

- Unreported cryptocurrency transactions

The IRS uses algorithms to score returns—proper documentation eliminates risk even with high scores.

How can you tell if the IRS is investigating you?

You’ll receive certified mail with specific notice number (CP or LTR series) or in-person visit from credentialed revenue agent—the IRS never initiates contact by phone, email, or text.

Official investigation signs:

- Certified letter requesting specific tax year documents

- Revenue agent schedules audit appointment in writing

- Multiple years of records requested simultaneously

- Subpoenas issued to banks or employers

- Questions about unreported income sources

Verify any IRS contact by calling 800-829-1040 directly with the notice number.

What is considered tax evasion versus tax avoidance?

Tax evasion is illegal willful fraud (hiding income, fake deductions, false returns), while tax avoidance is legal use of tax code provisions to minimize liability.

Evasion (criminal) examples:

- Underreporting income or omitting W-2s/1099s

- Claiming fake deductions without documentation

- Hiding money in offshore accounts

Avoidance (legal) examples:

- Contributing to 401(k) or IRA to reduce taxable income

- Using legitimate business deductions with proper documentation

- Tax-loss harvesting for capital gains

Tax evasion is a federal felony carrying up to 5 years prison and $250,000 in fines.

Qualify for IRS penalty relief programs? Licensed tax professionals can help you navigate first-time penalty abatement and other relief options.

Explore Relief Options →Filing Taxes Late: Key Details to Remember

Filing taxes late can result in significant penalties, interest charges, and even an IRS audit if left unaddressed.

However, taking steps to file your federal and state tax returns, even after the deadline, can help mitigate these consequences.

Tools like IRS Free File, payment plans, and professional tax advice are valuable resources for managing late filings. Filing your taxes late doesn’t mean you forfeit your right to a refund or credits, but you need to act quickly to avoid additional penalties.

To avoid future issues, stay organized, mark critical deadlines, and plan ahead for upcoming tax seasons.

Whether you handle your own taxes or work with a tax pro, addressing your tax obligations promptly is the best way to protect your financial health and avoid additional penalties from the IRS.

** About the Author: Willem Veldhuyzen is the founder and president of PriorTax and an IRS-enrolled professional. PriorTax has been in business for 20 years since 2006, and he’s hands-on with tax calculations, software updates, and customer support.

*** Disclaimer: This content provides general education about late tax filing and related IRS processes. It is not a substitute for advice from a licensed tax professional, CPA, enrolled agent, or attorney. Requirements can vary by tax year, and tax penalties and relief options depend on your circumstances. If you have IRS issues, questions about extension deadlines, or need decision-level guidance during filing season, verify details with official IRS/state sources and/or consult a qualified professional.

Categories:

Willem Veldhuyzen

Willem Veldhuyzen No Comments

No Comments