Dec 15, 2016

Dec 15, 2016

If you need to file a prior year tax return, you’ll have to mail it to the IRS…

Still need to get caught up on a prior year tax return? You’ll most likely need to paper file it. If this is the case, you’ll need the IRS address to send your return to.

You’ll be able to prepare any previous year tax return online, but you won’t be able to electronically file it. You’ll need to mail it to the IRS.

IRS address to file a late tax return

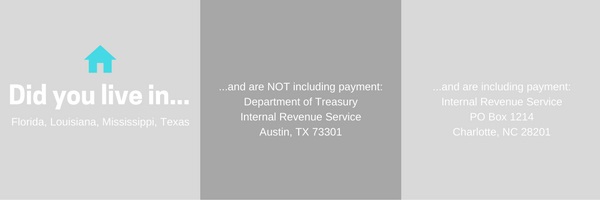

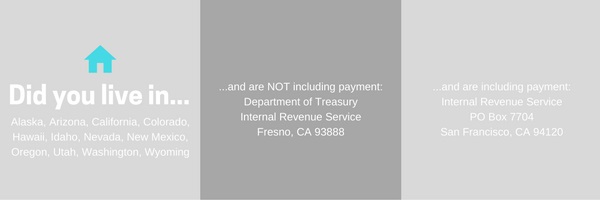

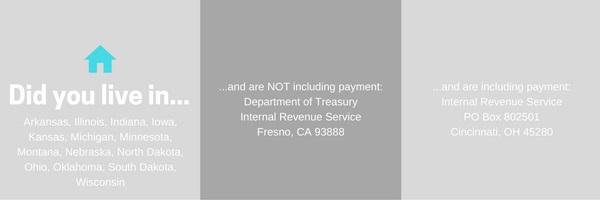

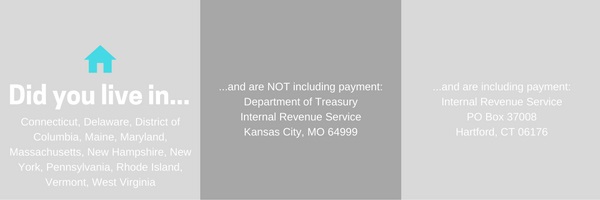

The address you’ll send your prior year tax return to will depend on what state you live in. Below, are five separate addresses on where to send a late tax return to. Please note that if you received a notice from the IRS with an alternate address, you should use that one.

Tax tips for filing a late tax return

Before sending off your late tax return, here are a few tips to keep in mind;

- If you are expecting a tax refund, you must file your return within three years of the original due date. After the three years, the IRS will keep that money.

- If you have a tax due amount, late penalties increase by the day. It’s best to file sooner rather than later!

- If you are self-employed, failing to file a return can result in not being able to receive credits for Social Security benefits.

Prepare your late tax return today!

Let’s be honest, doing your taxes and making a trip to the post office is not your definition of fun. However, with PriorTax, preparing a late tax return is pretty much effortless.

What are you waiting for? Create an Account today and get your prior year tax return out of the way today!

Tags:

Categories:

14 Responses to “IRS Address to File a Late Tax Return”

admin

admin 14 Comments

14 Comments

Comments(14)

Crystal

Apr 6, 2017

Do you know if I am mailing a late return from a country outside the U.S. what is the mailing date that is accepted? Must it be postmarked in the international country by April 15 or must it arrive at the IRS office before April 15?

admin

May 11, 2017

Hello Crystal,

When mailing in returns, it must be postmarked before the deadline.

TERRY MILLER

Apr 13, 2017

I live in Texas and I need to know where can I send my 2015 tax returns to

admin

May 11, 2017

Hello Terry,

Please visit the IRS website to determine your mailing address: https://www.irs.gov/uac/where-to-file-paper-tax-returns-with-or-without-a-payment

Jay

Jun 5, 2017

When mailing prior year”s tax returns do you need to include a cover letter or anything else besides the actual form and supporting paperwork?

admin

Jun 5, 2017

The only documents that need to be set to the IRS will be the tax forms and support income statement if you can provide them. There is no further forms or paperwork that needs to be included with the tax return.

Beth

Jun 26, 2017

I sent my taxes in two maybe three days late. I have not received my tax refund. Why would this be?

admin

Jun 26, 2017

Hello Beth,

The IRS usually delays your refund if they need additional documents-which they request via mail or if your return is under going additional review. However, if you filed a late tax return, can contact the IRS for more details pertaining to your refund at 1800-829-1040.

Reneta

Feb 2, 2018

Where do I send my taxes to file for 2016 and what will I need?

Ben

Mar 15, 2018

Hello, thank you for this article. If including payment, who do I make it (money order) out to? Just “Internal Revenue Servcie”? Thanks.

Manisha Hansraj

Mar 16, 2018

Hello Ben,

If you have received a notice which displays the address listed to mail your money order to the IRS, please use that address. Otherwise, you will need to select your state from this link to find the address you need to mail your late tax return.

ej

Aug 15, 2018

I mailed my 2015 and 2016 taxes this year to the Austin, TX address listed above in April. I can find any transcript info or documentation that it was received. Are you sure that the Austin address is correct for filing taxes this late? I just want to be sure I’m doing this right. Thanks

Manisha Hansraj

Aug 17, 2018

We recommend that you contact the IRS directly regarding the status of your tax return. Keep in mind, paper filed returns can take between six to eight weeks to fully process by the IRS. You may check the IRS site directly to ensure you are mailing your tax return to the correct address. You will need to select your state.

Shein Return Label

May 20, 2022

Really helpful article all about the irs address! You really have a great stuff on this topic! Thanks for the valuable information…