Jan 11, 2021

Jan 11, 2021For the 2020 tax year, there’s a new income statement.

The IRS has introduced a new form called Form 1099-NEC. Whether you’re well versed in reporting your taxes or not, this may be confusing.

Typically, your self employment income is reported on box 7 of your 1099-MISC statement. For the 2020 tax year it is now reported on a 1099-NEC. The IRS has done this to separate filing deadlines.

Why would you receive Form 1099-NEC?

Any business that makes non-employee compensation exceeding $600 to payees or withholds federal income tax from their payment must report a 1099-NEC.

That being said, if you received over $600 as a non-employee or independent contractor, you should expect this statement.

What is non-employee compensation?

Non-employee compensation is also known as self employment income. Here’s what the IRS deems as non-employee compensation.

- Payments for someone who is not your employee

- Services in the course of your trade or business

- You paid an individual, partnership or estate

- Payments to the payee of at least $600 during the year

The IRS recognizes examples of non-employee compensation payments as some of the following:

- Professional service fees, such as fees to attorneys, accountants, architects, contractors, engineers, etc.

- Fees paid by one professional to another (fee-splitting or referral fees)

- Payments by attorneys to witnesses/experts in legal adjudication

- Payment for services, even parts or materials used to perform the services if supplying the parts or materials was incidental to providing the service

- Commissions paid to nonemployee salespersons that are subject to repayment (but not repaid during the calendar year)

- A fee paid to a nonemployee, including an independent contractor, or travel reimbursement

For a complete list, click here. However, a 1099-NEC will not be required if the independent contractor is registered as a C corporation or S corporation.

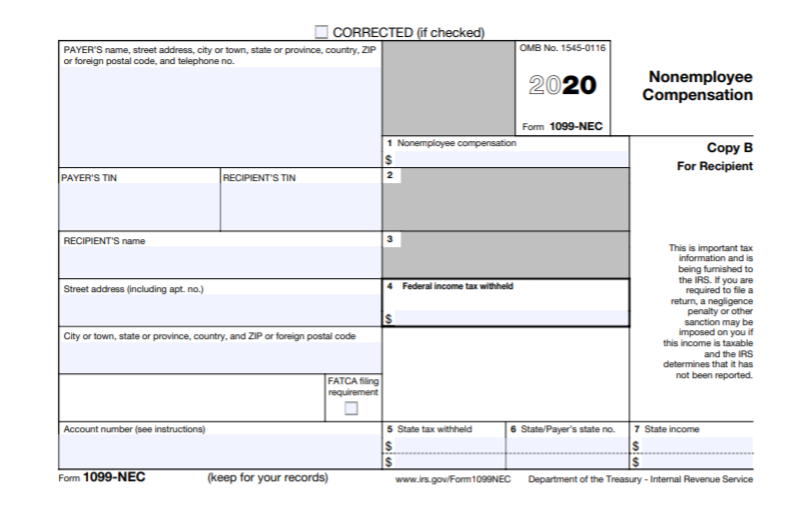

Here’s what the 1099-NEC looks like.

You will use this form to prepare your 2020 tax return and should receive this form by February 1; since January 31 falls on a weekend.

When do you file a 1099-MISC?

The IRS now uses this form for miscellaneous income. For example, if your business pays an individual or LLC at least $600 during the year in rent paid, legal settlements, or prize or award winnings, you are required to file a 1099-MISC.

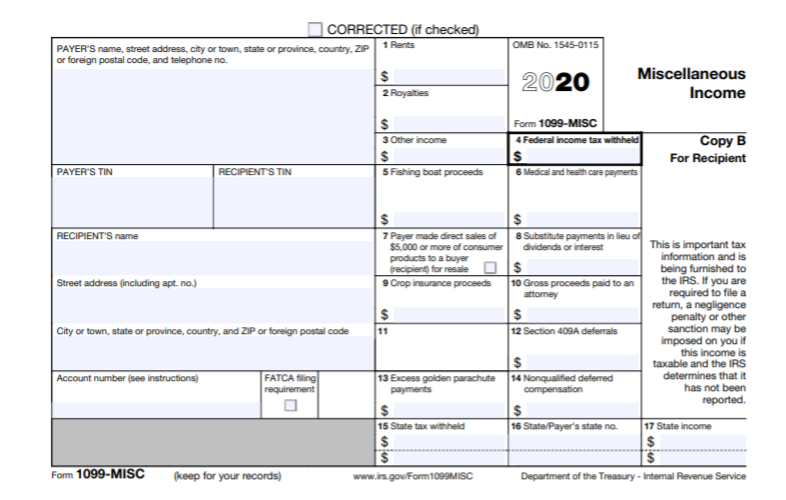

Changes to the 1099-MISC statement

The IRS has redesigned form 1099-MISC due to removing the non-employee compensation in box 7.

Here are the list of changes and their correlating boxes.

- Payer made direct sales of $5,000 or more – Box 7

- Crop insurance proceeds – Box 9

- Gross proceeds to an attorney – Box 10

- Section 409A deferrals – Box 12

- Non-qualified deferred compensation – Box 14

- Boxes 15, 16, and 17 report state taxes withheld, state identification number, and amount of income earned in the state

Filing dates

As an employer, you must file Form 1099-NEC on or before February 1, 2021. If you file on paper, you must file Form 1099-MISC by March 1, 2021. If you file electronically, you must file by March 31, 2021.

Are you ready for the new tax season?

You can now start on your 2020 tax return with us. Simply create an account, enter your tax information, and submit your account for e-file.

Otherwise, if you’re waiting on additional statements, save your progress and return to your tax information when you’re ready.

Tags:

Categories:

Manisha Hansraj

Manisha Hansraj No Comments

No Comments