May 4, 2023

May 4, 2023If you just realized you made a mistake on your taxes, don’t worry. You can fix it.

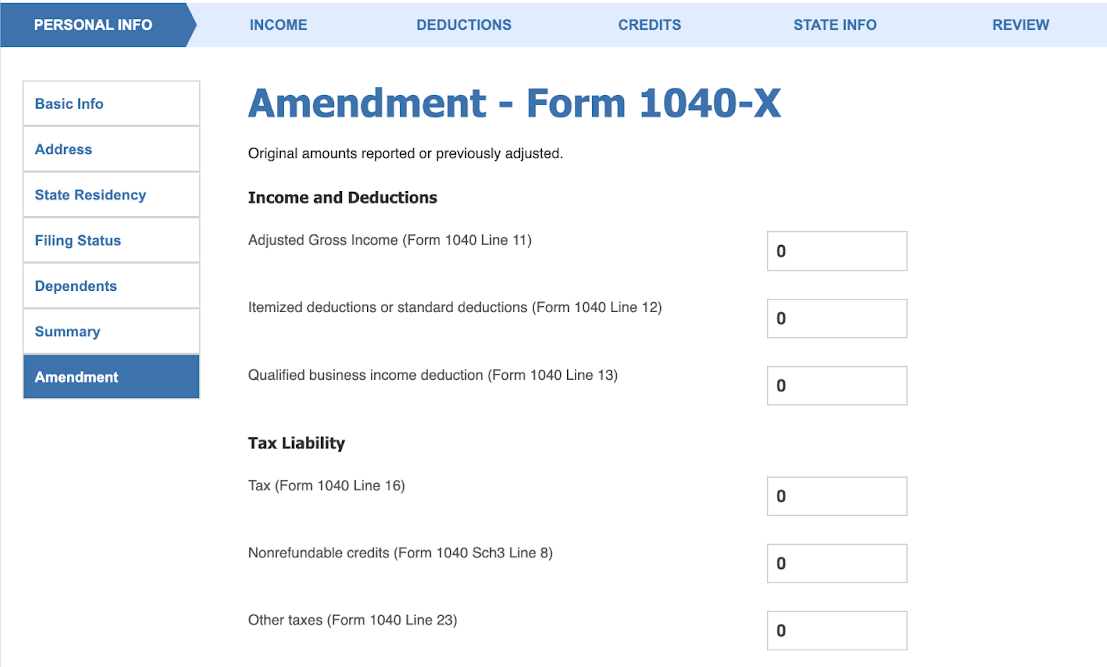

To amend tax return filings, you must use Form 1040-X, also known as the Amended U.S. Individual Income Tax Return. You can file this form to update your status, income, deductions, or credits after submitting your original return.

PriorTax makes amending your return simple and affordable. Our experts find every credit and deduction to maximize your refund and put cash back in your pocket.

From small errors to major life changes, we guide you through every step.

When can you amend a tax return?

You generally have a limited window to submit a tax return amendment and still claim a refund. In most cases, you must file Form 1040-X within three years from the date you filed your original return or within two years from the date you paid the tax, whichever is later.

For example, if you filed your 2023 taxes on April 15, 2024, you usually have until April 15, 2027, to amend a tax return for that year to claim a tax refund. It is important to know that while the IRS often catches math errors and fixes them for you, they will not automatically find missed credits or deductions that could put money in your pocket. That is why correcting tax return errors yourself is so important.

Why should you consider an IRS tax amendment?

Many people feel nervous about contacting the IRS again after they have finished their taxes. However, filing an IRS tax amendment ensures you don’t overpay. According to the IRS Data Book for 2023, approximately 3 million taxpayers file Form 1040-X each year to correct errors or claim missed benefits.

Common reasons for correcting tax return mistakes include:

- Changing your filing status: Moving from “Single” to “Head of Household” can significantly increase your standard deduction.

- Claiming missed credits: You might have forgotten the Child Tax Credit or the Earned Income Tax Credit.

- Adding missed expenses: You may have forgotten to include the costs for your business (Schedule C) or rental property (Schedule E), which can lower your tax liability.

- Adding dependents: If you forgot to list a child or a qualifying relative, you could be missing out on thousands of dollars.

- Reporting additional income: If you received a late W-2 or 1099 form, you must report the corrected information to avoid penalties later.

PriorTax is unique because we are the only online service that can e-file your 1040-X for up to three tax years. For instance, in 2026, you can e-file 2025, 2024, and 2023. While many other services require you to print and mail your forms, we utilize modern technology to expedite the process.

How does the tax amendment process work?

The tax amendment process is different from filing your regular taxes. You do not just file a whole new 1040. Instead, you use the IRS 1040-X to show the IRS what has changed.

The 1040-X form has three main columns:

- Column A: This shows the numbers from your original return.

- Column B: This shows the difference (the increase or decrease) in those numbers.

- Column C: This shows the new, corrected amounts.

You must also explain the tax return changes on your Form 1040X. At PriorTax, our system guides you through this process step-by-step. Our built-in checks ensure your return is filed quickly and correctly. Additionally, all filings are reviewed by our experts to ensure maximum refund potential.

Do you need to amend your tax filing for math errors?

Usually, you do not need to amend a tax filing for simple math mistakes. The IRS has powerful computers that catch and fix basic arithmetic errors during the initial processing. If they find a math mistake, they will send you a letter explaining the change and tell you if you owe more money or are getting a larger refund.

However, the IRS will not know if you missed a deduction or if you should have used a different filing status. If the change requires professional judgment or new information, you must take the lead and start the tax return correction yourself.

How do I file an amendment on Priortax?

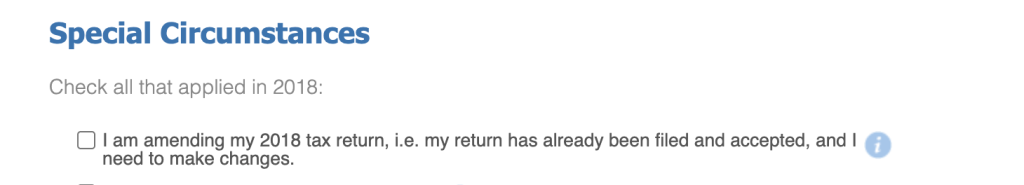

If you need to file amended tax returns from the current tax year to the prior tax year 2018, our website allows you to do so. Under the Special Circumstances section within your account, you can select the checkbox that you are amending your tax return.

For tax returns older than the tax year 2018, contact our customer support team so we can provide further instructions.

After checking this box, it will trigger the Amendment Form page, which allows you to input your originally accepted tax return data if you filed with another tax preparer. This will also include any refunds received or payments you made to the IRS, dependents, and an explanation of your changes.

On the other hand, if your original tax return was accepted with our services, this information will automatically be generated, so you can start making your changes.

After saving this section, you can continue entering the required information for your tax return to reflect your full updated tax return, which we will then provide you with after submitting your information to us.

Can you e-file your 1040X?

For many years, the 1040-X had to be printed and mailed. Now, you can e-file the Form 1040X for the current tax year and two prior tax years with our services. This is a major benefit because e-filed returns are processed much faster than paper ones.

PriorTax makes this even easier. We are open all year, so you do not have to wait for the “tax season” to fix your return. We can even help you prepare your taxes for paper filing all the way back to 2012. Even if you need to fix a return from several years ago, our professional and knowledgeable team is ready to assist you.

How long does it take for the IRS to process a tax return amendment?

Once you submit your tax return amendment, patience is key. It typically takes the IRS between 8 to 12 weeks to process an IRS Form 1040-X, though it can sometimes take up to 16 weeks.

You can track the status of your form using the “Where’s My Amended Return?” tool on the IRS website. You should wait at least three weeks after filing before you check the status. If you choose to e-file through PriorTax, you can also select direct deposit for your refund, which is the fastest and most secure way to get your money.

What should you do if you owe more money?

If your tax return changes show that you actually owe the IRS more money, you should file the 1040-X as soon as possible. This helps you avoid extra interest and penalties. You can pay the balance due online or by mail. If you file the amendment before the original tax deadline, you might even avoid penalties altogether.

Frequently Asked Questions About Amending Tax Returns

Can I amend a tax return from five years ago?

Generally, no. The IRS only allows you to claim a refund for “open” years, which is usually three years back. However, PriorTax can help you file original returns for years as far back as 2012.

Do I need to file a separate Form 1040-X for each year?

Yes. If you made mistakes in multiple years, you must file a separate 1040-X for each tax year you want to change. Each year’s form should be mailed in its own envelope if you are filing by paper.

Should I wait for my original refund before I amend?

Yes, it is usually best to wait until the IRS has processed your original return and you have received your original refund before you file your 1040-X. You can cash your first refund check while you wait for the amendment to process.

What documents do I need for a tax return amendment?

You will need a copy of your original tax return and any missing documents that support your changes. This might include an issued W-2, 1099, or receipts for a deduction you missed.

Is there a penalty for amending a tax return?

There is no penalty just for filing an amendment. However, if your amendment shows that you underpaid your taxes, you may have to pay interest on the amount you owe.

Why is PriorTax the best choice for your tax amendment?

Our brand promise is simple: we help hard-working taxpayers save money. We offer up-front pricing with no hidden fees, so you always know what you are paying before you file. Our live customer service agents are even available to give you basic tax advice if you are just trying us out. We stay up late so you don’t have to, working hard to meet every deadline.

Filing an amended tax return can feel overwhelming, but it does not have to be expensive. Many traditional CPAs charge high fees for amendments. At PriorTax, we offer online CPAs at a fraction of the cost.

You can scroll through our prior and current year pricing options here.

Take Control of Your Taxes Today

Don’t let a mistake on your taxes stress you out. Whether you need to fix a simple error or find a missed credit that puts money back in your pocket, PriorTax is here to help. We provide expert, professional, and authoritative guidance to ensure a smooth tax amendment process.

Our system is designed for “do-it-yourself” ease, but our tax pros are always available to advise you. With transparent pricing and the ability to file current and past-year returns, we are the partner you need to maximize your refund.

Ready to get started?

File your tax amendment now with PriorTax

Tags:

Categories:

One Response to “How to Amend Your Tax Return”

admin

admin 1 Comment

1 Comment

Comments(1)

Sikiru M Akande

May 8, 2023

i need to file for year 2020 tax amended