Dec 8, 2021

Dec 8, 2021Each year new tax tables are published by the IRS, which are used to determine how much tax each taxpayer owes. These tables include information about where the federal individual income tax brackets fall for each tax year.

Are you preparing a prior year’s tax return for 2019? Check out our awesome Tax Calculator 2019. Let’s discuss what you need to know about the tax brackets in 2019, including how they work and how they affect your tax situation.

What are tax brackets?

Each tax bracket is a range of two incomes, an upper and lower bound, which dictates the income range that is taxed at each tax rate. What income groups correspond to each of the seven brackets will depend on your filing status. For federal individual income taxes, there are seven tax brackets.

Why are tax brackets important?

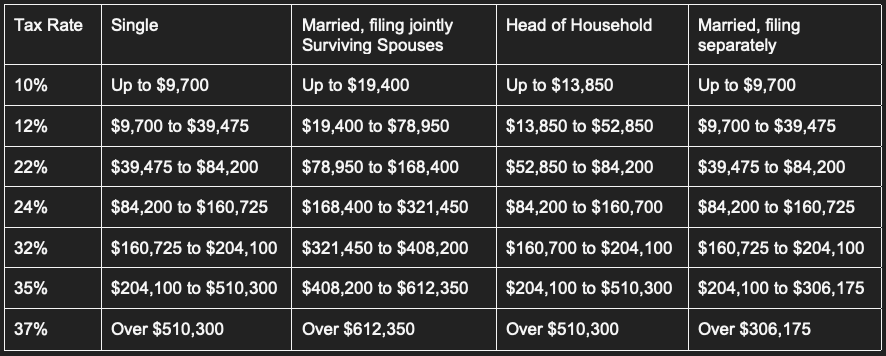

Each of the seven taxable income groups or tax brackets corresponds to a tax rate. The seven tax brackets in 2019 corresponded to the following tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

The U.S. personal income tax system is what is known as a progressive tax system. Tax brackets are used to group taxpayers according to income ranges. This creates lower tax rates for lower-income earners and higher tax rates for higher-income earners.

However, it’s important to keep in mind that only the income that falls within an income bracket will be subject to the bracket’s corresponding tax rate. This makes the tables a bit more complicated to read and use. But, it also means that just because your income might put you into a higher tax bracket, not all of your income will be taxed at the corresponding higher tax rate.

How to use the 2019 tax brackets?

What information do you need before starting?

When reading the 2019 tax brackets, you need two main pieces of information: your total taxable income and your filing status for the 2019 tax year.

There are five different Filing Statuses for federal income taxes. Your status will depend on factors such as your marital status, occupation, number of children. The five different categories are:

- Single

- Married, filing jointly

- Head of Household

- Married, filing separately

- Surviving Spouse/Widow(er)

The IRS website offers a web application, their Interactive Tax Assistant, which can be used to make sure you accurately determine your status based on their guidelines.

Total Taxable Income

Total Taxable Income refers to the portion of your gross income that U.S. tax law considers subject to taxation. You arrive at this number by taking your Adjusted Gross Income (AGI) and subtracting any deductions you are entitled to, either itemized or the standard deduction. Your relevant adjustments will depend on your filing status and your sources of income and financial activity during the year.

The 2019 tax forms have instructions that you can follow to arrive at your total taxable income. However, an online tax filing application can help you calculate your total taxable income as part of preparing your 2019 tax return. You can visit PriorTax.com to learn more and get started today.

Now with both your filing status and total taxable income at hand, the table below can point you toward your relevant tax brackets for the 2019 tax year.

What calculations do you need to do to apply the 2019 tax brackets to your tax situation?

First, when looking at the tax brackets for 2019 or any other tax year, it’s important to remember that the U.S. personal income tax system uses a progressive tax system. This means reading and applying the 2019 tax brackets is not as simple as finding your filing status column and total taxable income row in the table above, applying the tax rate to your total taxable income, and then you’re done.

A few more calculations are needed to take into account the fact that although your total taxable income may put you into a higher tax bracket, the U.S. Government doesn’t tax all of that income at the corresponding higher tax rate.

So, what does this look like when applying the tax brackets to your tax situation?

To estimate your income tax obligations, you will need to multiply the tax rates for each bracket by the amount of your total taxable income that falls into that bracket. Once you have your tax for each bracket, you can add these up to get your total federal income tax obligation.

Now, let’s take as an example a single person with $45,000 in total taxable income in 2019.

$45,000 in taxable income falls into three tax brackets, so three tax rates apply: the 10%, 12%, and 22%.

1. Calculate your income tax due in the 10% bracket

Your income from $0 to $9,700 falls into this bracket, so:

$9,700 x 0.10 = $970

2. Calculate your income tax due in the 12% bracket

Your income from $9,700 to $39,475 falls into this bracket ($29,775 in total), so:

$29,775 x 0.12 = $3,573

3. Calculate your income tax due in the 22% bracket

This is your highest bracket. Your income from $39,475 to your total taxable income ($45,000) falls into this bracket ($5,525 in total or $45,000 – $39,475 = $5,525), so:

$5,525 x 0.22 = $1,215.50

4. Add up your income tax due in each bracket to obtain your total federal income tax obligation

$970 + $3,573 + $1,215.50 = $5,758.50

Want help calculating your taxes based on your income brackets? For help figuring your federal income tax obligations and all other aspects of preparing your 2019 tax return and any other prior-year tax return, visit PriorTax.com.

Tags:

admin

admin No Comments

No Comments