Nov 15, 2016

Nov 15, 2016

So you’ve accrued a bit of debt. It’s not the end of the world.

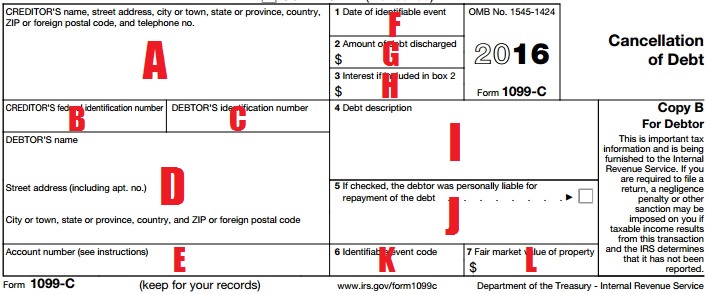

Debt is stressful, overbearing and can build up quickly. When this happens, you may need to eliminate it altogether. In a situation when you need to cancel your debt completely, you would contact your creditor and they’d issue you form 1099-C, as shown below.

What is form 1099-C?

The 1099-C is also known as the Cancellation of Debt. The most common reasons that you would receive this form are as follows:

- You’ve not made any payment on a debt for at least three years and there has been no collection activity for the past year.

- You negotiated a settlement to pay your debt for less than the amount you owed and the lender/creditor forgave the remaining amount.

- You sold a home in a short sale where the lender/creditor agreed to accept less than the full amount due to them

- You’ve owned a home that entered into foreclosure with a deficiency (the difference between the value of the home and your debt on it) which was forgiven or remains unpaid.

What does each box on the 1099-C mean?

Tax forms, in general, are intimidating to most of us. The tricky language and minuscule text paired with our immediate panic can send anyone into a frenzy. Let’s break this form down box by box and see if all your questions can’t be answered.

Box A: Creditor’s name, street address, and telephone number

Your creditor is the person or company that loaned you the money that you accrued debt from. They are the ones who lended you the money in the first place. This could be a bank, supplier, or even a person. Either way, their name, full address, and telephone number will be listed in this space.

Box B: Creditor’s federal identification number

Depending on if your creditor is a person or company, this space will include either the person’s social security number or the business tax identification number. It’s basically how the IRS knows who the creditor is.

Box C: Debtor’s identification number

The debtor is you and you are the debtor. Therefore, this is how the IRS identifies you. Depending on your situation, you will find one of the following in this space:

- Social security number

- Individual taxpayer identification number

- Adoption taxpayer identification number

- Employer identification number

If you only see a portion of the number (ie: the last four digits of your SSN), don’t panic. The full number was submitted to the IRS.

Box D: Debtor’s name and street address

Again, you are the debtor.This space will show your full name and address.

Box E: Account number

This may or may not be filled out. If so, it is the number that the creditor used to identify your account with them.

Box F: Date of identifiable event

A slightly terrifying way of stating the date your debt was officially cancelled.

Box G: Amount of debt discharged

This is how much debt you had cancelled. It’s the remaining amount that was not paid to the creditor. It isn’t the total debt you had with the creditor.

Box H: Interest if included in box 2

If interest was included with the canceled debt amount in box 2, then it will be shown here. It is not required to be reported. If interest is included in box 2 then it must be included in box 3 (or Box G in my diagram).

Box I: Debt Description

This will show a description of debt according to the creditor. If your 1099-C is combined with a 1099-A, then the property description will be here and box 7 (box L in my diagram) will be completed.

Box J: Debtor’s personal liability

This box will be marked if you were personally responsible for responsible for the debt at the time the debt was created or, if modified, at the time of the most recent modification.

Box K: Identifiable event code

This will show one letter. The letter is code for why your creditor issued this form to you. The possible codes and their descriptions are as follows:

- Bankruptcy

- Other judicial debt relief

- Statute of limitations or expiration of deficiency period

- Foreclosure election

- Debt relief from probate or similar proceeding

- By agreement

- Decision or policy to discontinue collection

- Expiration of nonpayment testing period

- Other actual discharge before identifiable event

Box L: Fair market value of property

This will show the fair market value of the property if it was abandoned or foreclosed to cancel your debt within the same calendar year. The other option in this situation if for your creditor to issue you a 1099-A. This can typically be listed as the gross foreclosure bid price. If the property was abandoned instead of foreclosed, then the value shown is typically the appraised property value.

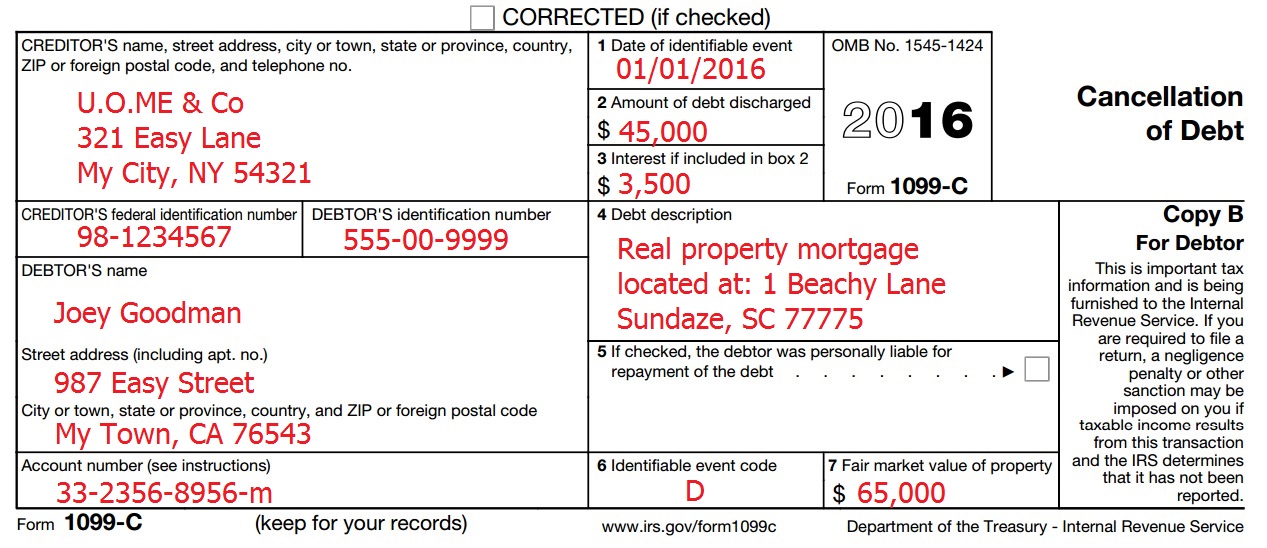

Let’s take this one step further. Here is a 1099-C as it would look if you received it in the mail.

Do I pay taxes on my cancelled debt?

So your debt was forgiven. Out of sight, out of mind, right? Not quite. Generally speaking, you are required to report that forgiven debt as income on your return and pay tax on it. Now, before you hand a check over to the IRS, there are exceptions that you could qualify for that would exclude you from paying tax on your debt. Let’s take a look.

- You filed for bankruptcy protection and debt was forgiven in bankruptcy.

- Mortgage debt was forgiven due to foreclosure.

- Debt from student loans was forgiven due to a loan provision based on service in your field of work..

- Interest that would have been deductible was forgiven.

- Cancellation of debt was a gift. This is more commonly seen among family or friends.

- Debts were cancelled because you are insolvent; meaning your assets are less than the remaining debt you owed.

- Real estate debt was forgiven because the property was worth less than you owed.

- The cancelled debt was in relation to your farm.

If you qualify for any of the above exclusions, you will need to also file form 982 to the IRS. For more information on exceptions to paying tax on 1099-C forgiven debt, you can visit the IRS website. Also, feel free to reach out to the PriorTax support team. We’ll assist you in preparing your tax returns and our user-friendly application will fill out the IRS forms so you don’t have to.

Tags:

Categories:

Michelle O'Brien

Michelle O'Brien No Comments

No Comments